Update on: April 18, 2021

The answer is a big YES. They can apply for a BPO Loan, personal loan, salary loan, call center agent loan, so on and so forth, provided that all eligibility requirements are met. They can take advantage of the unsecured loan with flexible terms and low interest rate offered by different financial institutions in the Philippines. Learn more or apply now online at Loans Dito Philippines.

Call Center Agent loan is a non-collateral type of loan designed for people working in the call center industry. A minimimum monthly basic salary of ₱25,000 for National Capital Region and Greater Manila Area based applicant is required to be eligible to apply for a loan with the bank. For call center agents or BPO employees outside of NCR and GMA may also be eligible to apply as long as their monthly basic salary is above ₱18,000 and provided that all other eligibility requirements are met.

| Loan Type | : | Conumer Loan |

| Loanable Amount | : | ₱30,000 up to ₱2,000,000 |

| Loan Terms | : | 12, 18, 24, 36 mos |

| Monthly Interest Rate | : | 1.39% - 3.00% |

| Collateral | : | Not required |

| Processing Time | : | 3 - 7 Business days |

Note: The range of monthly interest rate specified above may change at anytime without prior notice.

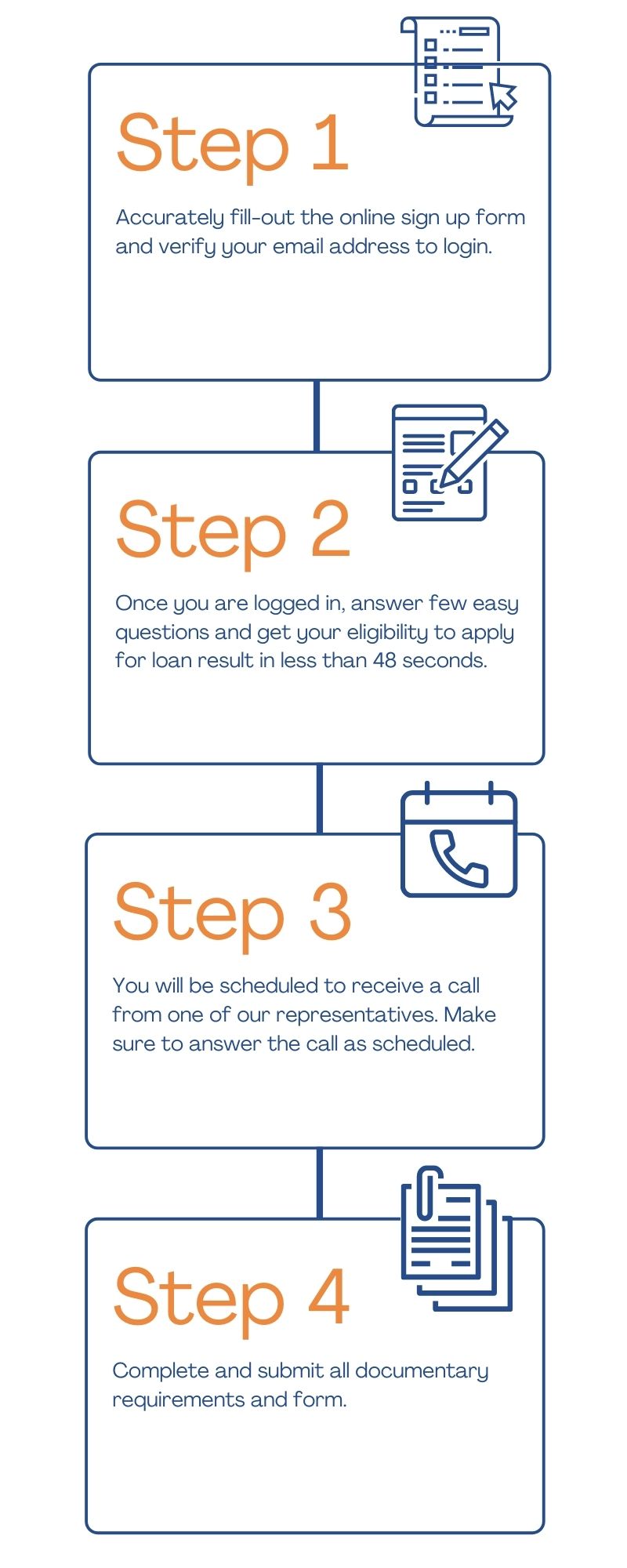

Applying online for a Call Center Agent Loan is easy. Just follow the easy steps below. Once you are all set, it only takes less than 48 seconds to get your eligibility-to-apply-for-loan result.

Completely fill-out the sign-up form to submit. You will receive a verification code with your login credential via email.

Once you are logged in, accurately answer few easy questions and get your eligibility to apply for loan in no time.

Our system will automatically schedule you to receive a call from one of our representatives. Ensure to take the call to avoid any delays.

Note: Our official and dedicated phone numbers for outbound calling are +63.905.24.WAYNE (92963) and +1.888.94.WAYNE (92963). Any calls or sms received other than these numbers are not from Loans Dito.

Completely submit all documentary requirements needed for the processing of your loan application.